Empowering New & Existing Businesses to Grow with Better Credit Education

No red tape. Just the truth about how to build real business credit.

This Is How Businesses Really Build Leverage

We teach TikTok shop owners, influencers, ecommerce brands, and media buyers how to build real business credit the kind banks still don’t get.

About Us

Tradeline Secrets: Real Business Credit Education for Real Entrepreneurs

We help business owners understand how to build strong business credit and position themselves for big opportunities.

No gatekeepers. Just real education on how to make business credit work for you.

Our Mission

Business credit shouldn’t feel like a maze.

We’re here to bring transparency to how business credit really works so owners know exactly how to build, grow, and use it with confidence.

Personal finance is already messy enough.

We cut through the noise and give you clear, actionable steps you can use right now.

Why Choose Us

We go beyond education... we’re here to help you grow.

We show you how to build real business credit so you can open doors on your own terms.

And when it’s time to move, we’ll be right there helping you.

Our Commitment

No hidden formulas. No industry secrets.

We believe transparency wins. Always has. Always will.

Whether you’re just learning how business credit works or already leveling up, our mission is the same... help you build control over your business future.

Discover How Top Entrepreneurs Build the Credit Strength to Access Big Opportunities.

Business Education

We Work With Every Kind of Entrepreneur

Here’s just a sample… chances are, you’ll fit in here too.

We work with every kind of entrepreneur.

Not just the ones traditional systems pay attention to.

The Modern Guide to Business Credit Education

Banks Won’t Teach You This… But We Will.

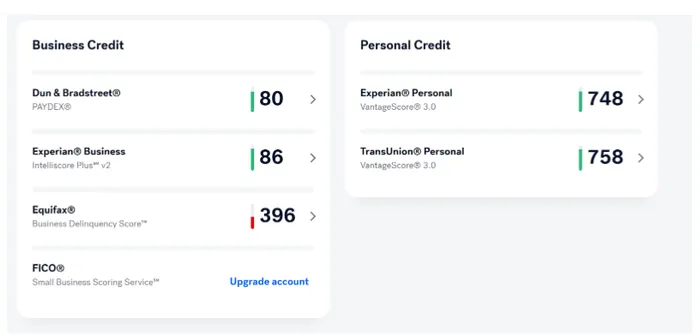

Learn to build business credit and a Paydex score.

Most business credit guides are recycled junk from the early 2000s or written by people who have never built anything real

This is built from real work with real entrepreneurs.

Do the steps and you will know how to build a strong profile.

Grab the Tradeline Secrets Guide and Learn How to Build Business Credit Like the Pros Do

Learn which vendor accounts report, which don’t, and how to sequence them to grow your Paydex faster

Discover how to properly structure your business info so everything matches across the board

Understand how pros structure their credit strategy to maximize access and minimize risk

Get the inside perspective on how new businesses build credit power early

Understand how credit cycles work and how to use them strategically

Follow Us For Free Education

Contact Us

Legal

No client’s success, earnings, or production results should be viewed as typical, average, or expected. Not all clients achieve the same of similar results, due to many factors. Client testimonials are true and accurate statements from actual clients.

© Tradeline Secrets 2026 All Rights Reserved.

Facebook

Instagram

LinkedIn

Youtube

TikTok